Cincinnati, OH – Fifth Third Bank has agreed to pay $20 million in penalties following an investigation by the Consumer Financial Protection Bureau (CFPB) into its auto insurance practices and the creation of fake customer accounts. The penalties aim to address the bank’s illegal activities that have harmed thousands of customers.

The CFPB’s investigation revealed that Fifth Third Bank had been charging customers for unnecessary auto insurance policies, which affected over 35,000 customers. This unethical practice led to vehicle repossession for more than 1,000 customers who were deemed delinquent due to the unwarranted charges. The CFPB’s statement highlighted the severity of the issue, noting that customers faced additional fees and repossessions because of the bank’s actions.

In addition to the auto insurance scandal, Fifth Third Bank has also been implicated in incentivizing employees to create fake customer accounts. This practice was initially brought to light in a 2020 lawsuit. The CFPB has proposed a court order requiring the bank to pay $15 million in penalties related to these fraudulent activities. Moreover, the order includes a ban on setting employee sales goals that encourage the creation of fake accounts.

Susan Zaunbrecher, Fifth Third’s chief legal officer, commented on the settlement, stating, “Today’s settlement concludes both the sales practices litigation with the CFPB, and its separate investigation into certain auto finance servicing activities related to a collateral protection insurance program that the Bank shut down in 2019 before the CFPB began its investigation. We have already taken significant action to address these legacy matters, including identifying issues and taking the initiative to set things right. We consistently put our customers at the center of everything we do.”

The penalties will be paid into the CFPB’s victim relief fund, which aims to provide restitution to those affected by the bank’s practices.

This is not the first time Fifth Third Bank has faced penalties from the CFPB. In 2015, the bank was ordered to pay $18 million to Black and Hispanic borrowers affected by discriminatory auto loan pricing. Additionally, the bank was fined $3.5 million for illegal credit card practices.

As Fifth Third Bank moves forward, it must adhere to the CFPB’s directives to clean up its business practices or face further consequences. The resolution of these issues is crucial for restoring trust and ensuring the bank’s commitment to ethical practices.

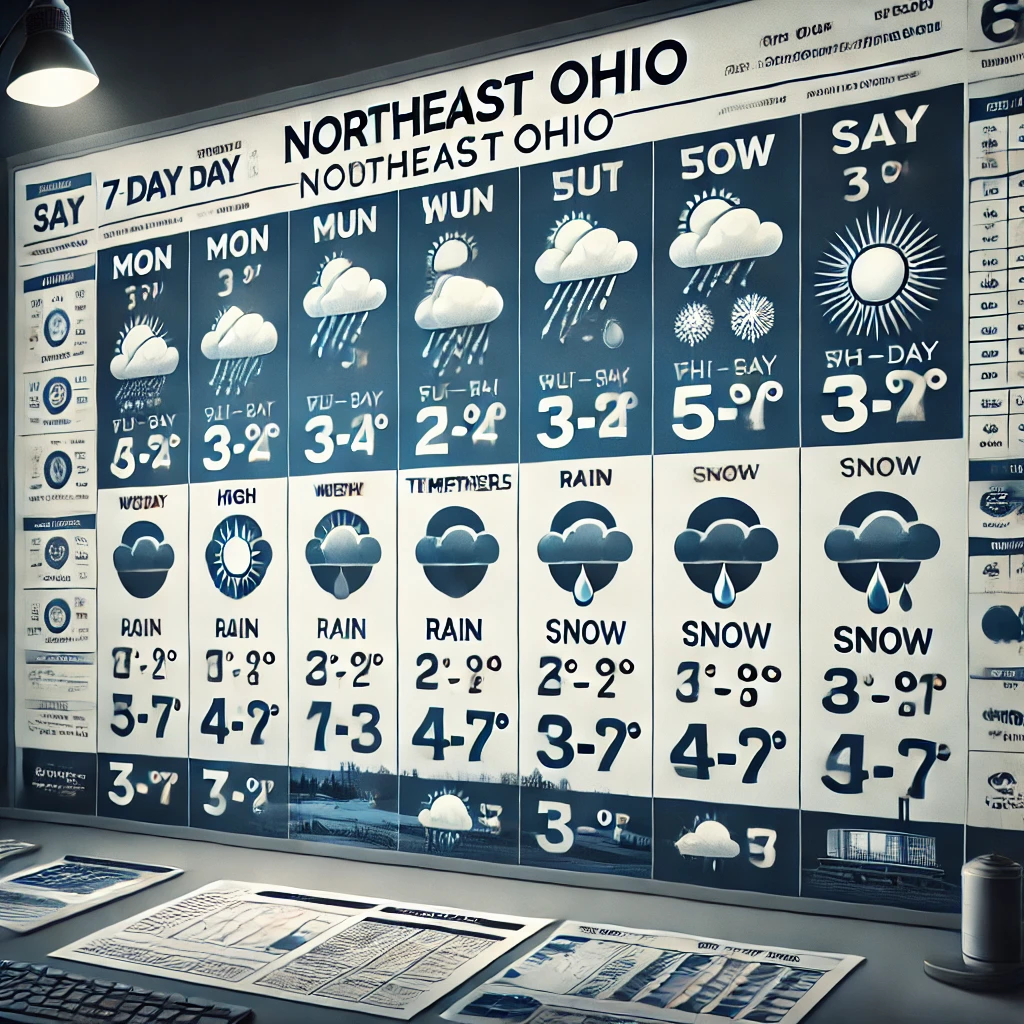

Discover more from Northeast Ohio News

Subscribe to get the latest posts sent to your email.