Northeast Ohio residents can breathe a little easier when it comes to credit card debt, according to a new national study. Both Akron and Cleveland ranked among the cities with the lowest household credit card debt in the country, offering a bright spot amid rising national consumer debt trends.

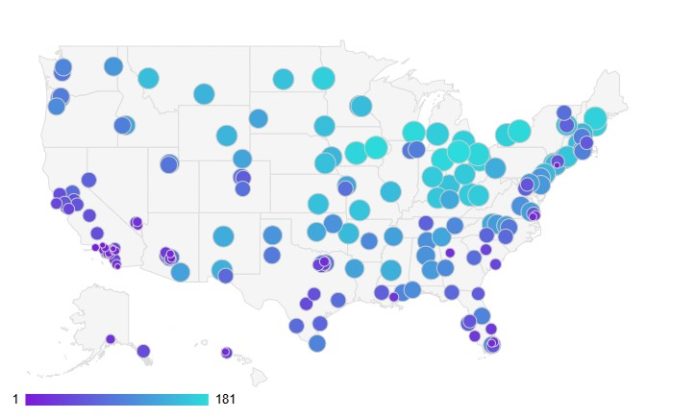

WalletHub’s latest analysis of more than 180 major U.S. cities found Akron ranking 174th and Cleveland at 176th for household credit card debt levels. The rankings place both cities near the bottom of the list, meaning residents carry less debt compared to their counterparts in other major metropolitan areas.

The personal finance website used the most recent consumer data from TransUnion and the Federal Reserve, adjusting all figures for inflation to provide accurate comparisons across different markets.

While the study reveals that U.S. credit card debt has reached $1.36 trillion nationally and is expected to grow by another $100 billion this year, Northeast Ohio appears to be bucking the trend. The low rankings suggest local residents may be less vulnerable to credit score damage and high interest costs that plague consumers in other parts of the country.

California cities dominated the highest debt rankings, with Santa Clarita, Chula Vista, and Rancho Cucamonga taking the top three spots. New York City ranked third nationally for highest household credit card debt.

The study aimed to identify areas where residents face the greatest financial vulnerability as consumer debt continues climbing nationwide. For Northeast Ohio, the results indicate local economic conditions or spending habits may be helping residents avoid the debt traps affecting other regions.