The wearable communication device market is experiencing dramatic growth and equally dramatic failures as companies rush to develop the next generation of body-worn tech. While smart glasses emerge as the clear frontrunner for 2025, the spectacular collapse of Humane’s AI Pin serves as a sobering reminder of the challenges facing this nascent industry.

Smart Glasses Dominate Development Pipeline

Major tech companies are investing heavily in smart glasses, with Samsung, Meta, and Google leading the charge toward consumer-ready devices expected by late 2025.

Samsung plans to launch AR glasses in Q3 2025 with an initial production run of 500,000 units. The devices will feature Galaxy AI, multiple cameras, and support for payments, gestures, and facial recognition. The company has filed patents for auto-correcting prescription lenses using gear mechanisms that can adjust focus dynamically.

Meta is launching “half a dozen” new AI-powered wearables in 2025, including the Hypernova glasses paired with a neural wristband that reads electrical signals from hand movements. The wristband uses sEMG sensor technology to interpret gestures, though testing has revealed challenges with fit and positioning.

Google’s Android XR platform will arrive in 2026, designed to work with internal lens displays. The company has filed patents describing how smart glasses could support prescription lenses installed at eyeglass stores or via manufacturers.

Prescription Integration Emerges as Key Challenge

One of the biggest hurdles facing smart glasses adoption involves accommodating users who need vision correction. Companies are pursuing different approaches to integrate prescription lenses with display technology.

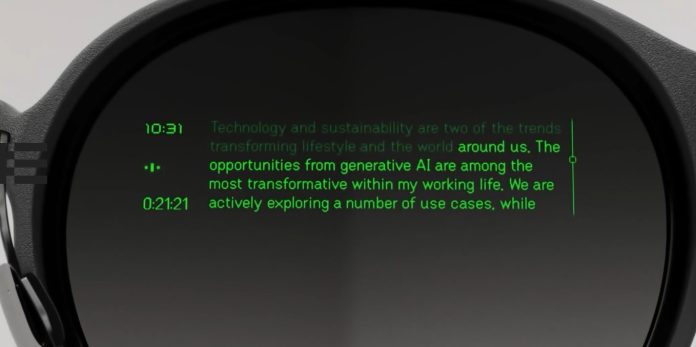

The industry uses two main methods: fully bonded lenses and clip-in systems. Even G1 uses a proprietary process bonding prescription lenses directly to waveguide display components, creating ultra-slim lenses no thicker than standard glasses while preventing dust and moisture infiltration.

Alternative systems use separate prescription lens inserts that clip behind the main display lens. While more flexible, these systems add bulk and create gaps where debris can accumulate.

Samsung’s advanced approach involves adjustable prescription systems using mechanical actuators. Recent patents describe smart glasses with displays and prescription lenses that adjust distance automatically via gear mechanisms, potentially eliminating the need for traditional prescription fitting.

Google’s patent filings show lens rims with two layers – one for information display and another for prescription correction – allowing users to swap in the correct prescription for their eyes.

Current market leaders like Ray-Ban Meta, Solos, and Halliday already offer prescription integration through traditional optical channels, requiring users to provide valid prescriptions during ordering.

Market Growth Accelerates Despite Challenges

The wearable device market is projected to reach 590.7 million units shipped this year, driven by advances in AI integration, enhanced connectivity, and diversifying form factors.

Smart rings have emerged as a surprising growth category, with Samsung’s Galaxy Ring and Oura Ring 4 leading adoption. Future rings may incorporate voice-activated AI assistants, blurring lines between fitness tracking and communication devices.

Hearables continue evolving beyond audio, with 2025 models from Sony and Jabra featuring heart-rate sensors. Samsung and Apple may follow suit, creating ecosystems of body sensors that complement smartwatches.

Enhanced connectivity through 5G networks enables real-time data transmission between wearables and AI-driven systems. University of Arizona researchers developed devices that transmit health data 2,400 times farther than Wi-Fi without significant infrastructure.

Humane’s $230 Million Failure Offers Stark Lessons

The cautionary tale of Humane’s AI Pin demonstrates the risks facing wearable startups. Founded by former Apple directors Imran Chaudhri and Bethany Bongiorno, Humane raised $230 million from high-profile investors including OpenAI CEO Sam Altman and Salesforce CEO Marc Benioff.

The $699 AI Pin, launched in April 2024, promised to replace smartphones through voice commands, gestures, and palm projections. Instead, it became one of tech’s most spectacular failures.

Reviews were universally negative. Popular tech reviewer Marques Brownlee called it one of the worst products he had ever reviewed, citing slow performance, unreliable operation, terrible battery life, and no advantages over smartphones. The Verge concluded that after extensive testing, the only reliable function was telling time.

Sales data revealed the depth of the disaster. Humane shipped only 10,000 units by August against hopes for 100,000 annual sales. Between May and August, more customers returned AI Pins than purchased them. The company also recalled charging cases due to fire hazards.

Internal dysfunction contributed to the failure. Employees who raised concerns about device viability were dismissed or fired. The founders reportedly “preferred positivity over criticism,” leading frustrated employees to leave when feedback was ignored.

HP acquired Humane’s assets for $116 million in February – far less than the $750 million to $1 billion the company initially sought. The AI Pin service shut down February 28, leaving customers with non-functional devices. Only buyers within 90 days received refunds.

Industry Outlook Remains Positive

Despite Humane’s failure, industry observers remain optimistic about wearable communication devices. The key difference lies in companies building practical solutions for existing problems rather than attempting wholesale smartphone replacement.

Successful wearables complement rather than replace smartphones, offering specialized functions like health monitoring, hands-free communication, or augmented information display. Companies focusing on specific use cases while maintaining reasonable pricing show more promise than revolutionary all-in-one devices.

The prescription lens challenge represents both obstacle and opportunity. Companies that solve vision correction elegantly may gain significant competitive advantages in a market where many potential users require corrective eyewear.

As Samsung, Meta, and Google prepare major launches, the wearable communication landscape approaches a crucial inflection point. The success or failure of upcoming smart glasses will likely determine whether wearables achieve mainstream adoption or remain niche products.

The Humane AI Pin’s demise serves as a reminder that impressive technology demonstrations, celebrity investors, and positive media coverage cannot substitute for functional products that solve real problems at reasonable prices.

Related: Why Smart Glasses Are Racing Ahead: Development Timeline Reveals Key Advantages Over Smartphone Era